Credit scores have become a fundamental part of managing personal finance. They determine loan approvals, credit card eligibility, mortgage rates, and sometimes even employment opportunities. Platforms like GoMyFinance.com claim to simplify this process by offering an easy-to-understand credit dashboard. The key question remains: Is GoMyFinance.com Credit Score reliable, or is it primarily a marketing tool?

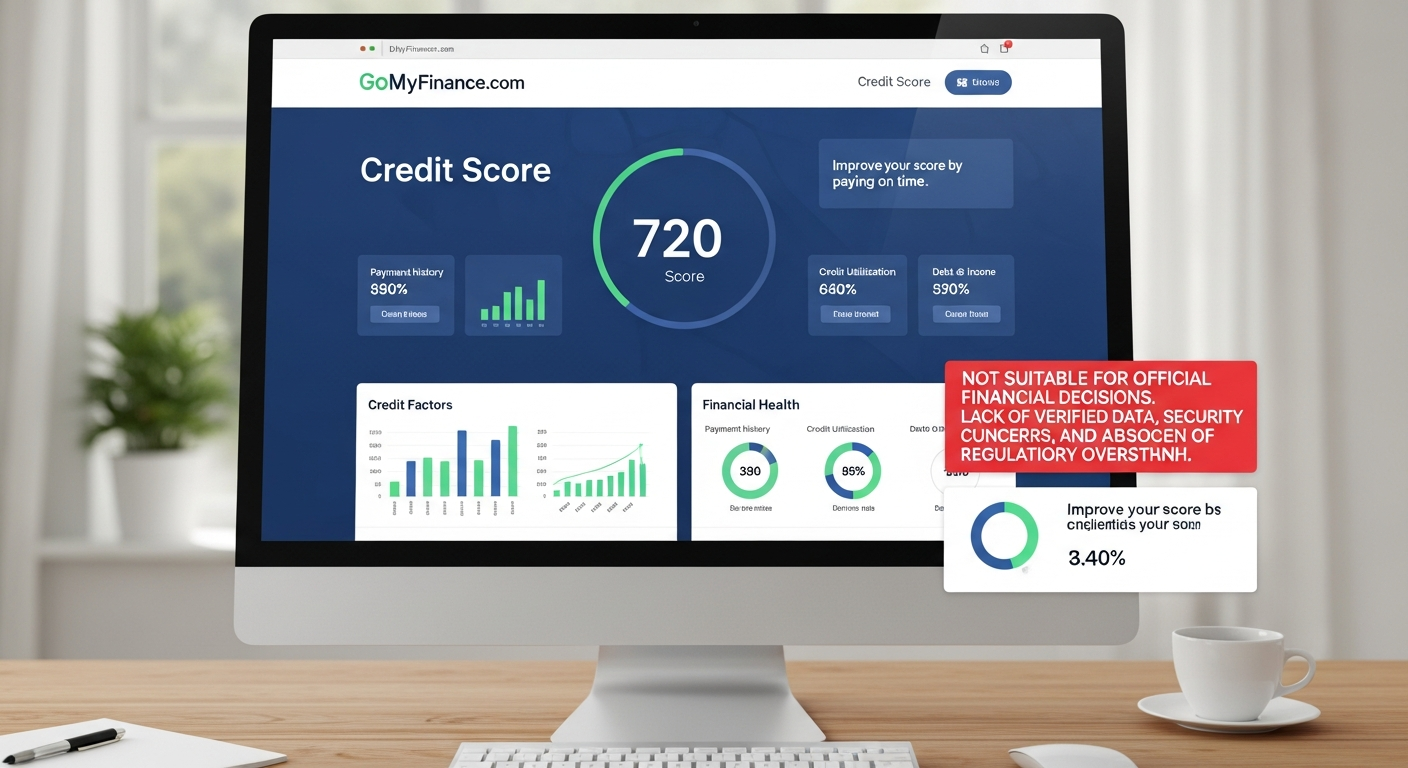

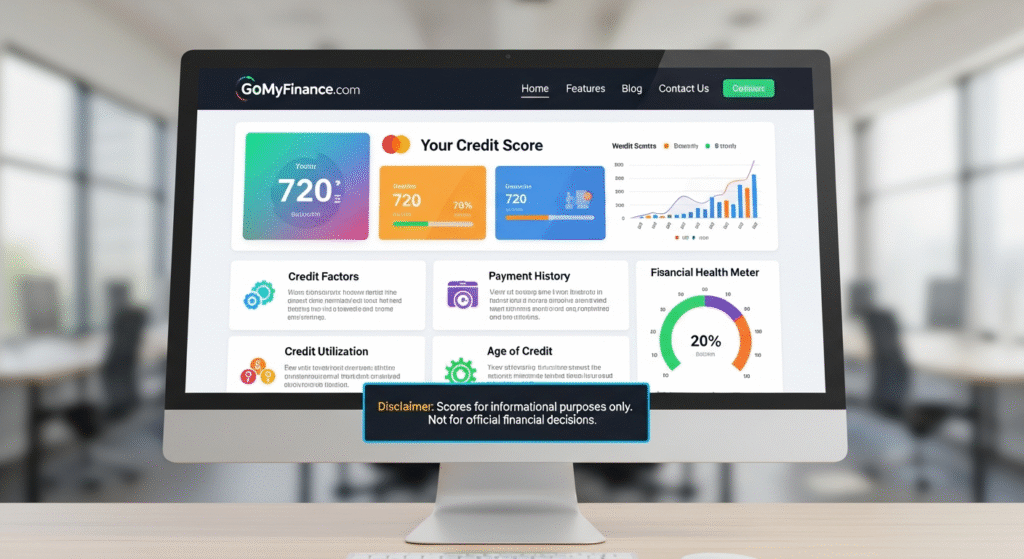

GoMyFinance.com Credit Score is presented as a tool that provides insights into your financial health. Users can supposedly view their credit rating, analyze factors affecting their score, and receive tips to improve it. While the interface is user-friendly and visually appealing, the legitimacy and real-world applicability of this score require careful examination.

What GoMyFinance.com Credit Score Claims to Offer

GoMyFinance.com Credit Score claims to provide a complete picture of an individual’s credit health. The platform displays a three-digit score ranging from 300 to 850, similar to traditional credit scoring models. It also provides details on payment history, credit utilization, account age, and credit mix.

The website highlights that checking your GoMyFinance.com Credit Score involves only soft inquiries, which are said to have no negative impact on your credit. Additionally, the platform offers guidance on how to maintain a healthy financial profile, including advice on timely payments, responsible credit utilization, and avoiding unnecessary credit applications. These tips align with conventional credit management practices, but the authenticity of the score remains unverified.

Evaluating the Reliability of GoMyFinance.com Credit Score

Independent analysis raises several concerns about the credibility of GoMyFinance.com Credit Score. First, the platform lacks transparency regarding ownership and regulatory affiliations. There is no verified evidence that GoMyFinance.com partners with recognized credit bureaus to generate accurate credit scores. This raises questions about whether the score truly reflects a user’s financial standing.

Security is another area of concern. Some users report inconsistent encryption protocols and potential vulnerabilities in handling personal data. Furthermore, the platform often presents promotional content alongside the credit dashboard, which can confuse users into believing that marketing materials are genuine credit insights.

Table: GoMyFinance.com Credit Score vs Official Credit Bureaus

| Feature | GoMyFinance.com Credit Score | Official Credit Bureaus (Experian, Equifax, TransUnion) |

| Data Source | Proprietary algorithm, unclear origin | Verified data from banks, lenders, and financial institutions |

| Score Recognition | Not recognized by lenders | Widely accepted by financial institutions |

| Security | Limited transparency, possible encryption issues | Regulated and compliant with financial security standards |

| Accuracy | Unverified and approximate | Accurate, based on actual credit history |

| Impact on Loans | Minimal to none | Direct influence on loans, credit cards, and mortgages |

Why GoMyFinance.com Credit Score Attracts Users

Despite these limitations, GoMyFinance.com Credit Score has attracted many users. The platform provides a visually engaging dashboard that gives the impression of control over one’s finances. For beginners who are intimidated by official credit bureau platforms, this can be an accessible entry point into understanding credit.

The educational content accompanying GoMyFinance.com Credit Score helps users understand factors affecting credit health, including payment consistency, credit utilization, and account longevity. While these tips are generally helpful, users need to understand that the score itself may not hold official weight with lenders or financial institutions.

Potential Risks of Relying on GoMyFinance.com Credit Score

The main risk associated with using GoMyFinance.com Credit Score is the illusion of reliability. Users may assume their displayed score accurately reflects their financial standing and rely on it for loan applications or credit decisions. In reality, since the score is not linked to verified credit bureaus, it may not be recognized by lenders.

There are also privacy concerns. Inconsistent encryption and lack of regulatory oversight can expose users’ personal and financial data to potential misuse. Users outside the United States face an additional limitation: the platform’s U.S.-oriented algorithm may not correspond to local credit systems, making it less useful for international financial decisions.

Comparing GoMyFinance.com Credit Score With Traditional Monitoring

Understanding how GoMyFinance.com Credit Score differs from official credit monitoring helps users make informed decisions. Traditional credit bureaus collect verified data from banks, lenders, and financial institutions. Their scores directly influence loan approvals, interest rates, and credit card eligibility.

GoMyFinance.com Credit Score, on the other hand, uses an algorithm not validated by official financial authorities. While it may serve as an educational tool, it should not replace verified credit reports for real-world financial decisions.

Table: Differences Between GoMyFinance.com Credit Score and Traditional Credit Monitoring

| Aspect | GoMyFinance.com Credit Score | Traditional Credit Monitoring |

| Score Source | Proprietary, unverified algorithm | Verified data from banks and lenders |

| Regulatory Oversight | None | Fully regulated by financial authorities |

| Financial Impact | Minimal | Directly impacts loan approvals and credit card eligibility |

| Security | Limited transparency | Strong compliance with security standards |

| Global Applicability | Limited | Recognized in multiple countries |

Best Practices for Monitoring Credit

While GoMyFinance.com Credit Score can serve as an educational tool, users should rely on recognized credit bureaus for actual credit monitoring. Verified credit reports provide accurate insights accepted by lenders and allow for practical financial planning.

Responsible financial behavior is essential. Timely payments, low credit utilization, maintaining older accounts, and avoiding excessive new credit applications are universally recognized methods to improve credit standing. Platforms like GoMyFinance.com Credit Score can help visualize progress, but verified reports should guide key financial decisions.

Tips to Improve Your Credit Score

Improving your credit score involves consistent and responsible financial management. Paying bills on time, keeping credit utilization low, maintaining older accounts, and limiting new applications form the foundation of a strong credit profile.

GoMyFinance.com Credit Score may help you track these behaviors visually. However, it is crucial to differentiate between educational insights provided by the platform and official data used by financial institutions to evaluate creditworthiness.

FAQs

Is GoMyFinance.com Credit Score recognized by lenders?

No. It is not officially recognized and should not be used for loan or mortgage approvals.

Will checking my GoMyFinance.com Credit Score affect my credit rating?

The platform claims soft inquiries that do not impact credit, but users should be cautious due to potential privacy concerns.

Can I trust the financial tips on GoMyFinance.com?

The advice about timely payments and credit management is generally valid, but the score itself is unverified.

Are there risks using GoMyFinance.com Credit Score internationally?

Yes. Scores generated through the platform may not align with local credit systems and have limited practical use outside the U.S.

What is the safest way to monitor credit?

Use recognized credit bureaus or government-approved services that provide verified reports accepted by lenders.

Can GoMyFinance.com Credit Score improve my real credit?

It can provide educational insights but cannot directly improve verified credit scores. Real improvement comes from responsible financial behavior.

Conclusion

GoMyFinance.com Credit Score offers an engaging, user-friendly platform to understand credit factors and general financial health. However, the lack of verified data, security concerns, and absence of regulatory oversight mean that its scores should not be relied upon for official financial decisions.

For educational purposes, GoMyFinance.com Credit Score can be useful to learn about credit behaviors. For actionable insights and real-world applications, verified reports from recognized credit bureaus are essential. A combination of responsible financial habits and official monitoring ensures long-term credit improvement and reliable financial planning.

Read More blogs at: cricksport.co.uk

Many creators rely on ImageFap to showcase personalized collections without restrictive upload rules, making it appealing for long-term hosting. The platform’s tagging system helps users move through categories efficiently. This flexible structure keeps ImageFap relevant for both casual visitors and content sharers seeking consistent engagement across diverse image themes.